Within this week, owners of more than 1,040,000 properties throughout the Lower Mainland can expect to receive their 2020 assessment notices which reflect market value as of July 1, 2019. Have you gotten yours? If not, Homeowners can learn the value of your home without waiting for a mailed assessment by visiting BC Assessment online.

It is the first time in the last 20 years that B.C.’s total property assessment values have gone down, according to BC Assessment.

Both detached homes and strata properties are down as much as 16 per cent throughout Metro Vancouver, with some values holding steady without any change and the prices holding steadier the further a property is from the city of Vancouver.

The biggest drops were seen in single-family home values in West Vancouver and UBC, both down 16 per cent year over year, followed by Richmond’s detached houses, down 14 per cent, and then Vancouver, Coquitlam and North Vancouver single-family homes – all down 11 per cent.

Market Trends For Single-family Residential Properties By Geographic Area:

| Single Family Home Changes by Community | 2019 Typical Assessed Valueas of July 1, 2018 | 2020 Typical Assessed Valueas of July 1, 2019 | % Change |

| City of Vancouver | $ 1,755,000 | $ 1,568,000 | -11% |

| University Endowment Lands | $ 5,904,000 | $ 4,946,000 | -16% |

| City of Surrey | $ 1,042,000 | $ 1,010,000 | -3% |

| City of Burnaby | $ 1,512,000 | $ 1,363,000 | -10% |

| City of Coquitlam | $ 1,254,000 | $ 1,121,000 | -11% |

| City of Port Coquitlam | $ 969,000 | $ 875,000 | -10% |

| City of Port Moody | $ 1,342,000 | $ 1,192,000 | -11% |

| City of White Rock | $ 1,310,000 | $ 1,196,000 | -9% |

| City of Richmond | $ 1,532,000 | $ 1,322,000 | -14% |

| City of New Westminster | $ 1,147,000 | $ 1,054,000 | -8% |

| City of North Vancouver | $ 1,510,000 | $ 1,351,000 | -11% |

| District of North Vancouver | $ 1,616,000 | $ 1,479,000 | -9% |

| District of West Vancouver | $ 2,803,000 | $ 2,356,000 | -16% |

Market Trends For Strata Residential Properties (e.g. condominiums) By Geographic Area:

Strata Home Changes by Community | 2019 Typical Assessed Valueas of July 1, 2018 | 2020 Typical AssessedValueas of July 1, 2019 | % Change |

| City of Vancouver | $ 740,000 | $ 686,000 | -7% |

| City of Burnaby | $ 623,000 | $ 569,000 | -9% |

| City of Coquitlam | $ 591,000 | $ 537,000 | -9% |

| City of Port Coquitlam | $ 533,000 | $ 486,000 | -9% |

| City of Port Moody | $ 648,000 | $ 615,000 | -5% |

| City of New Westminster | $ 547,000 | $ 500,000 | -9% |

| City of North Vancouver | $ 707,000 | $ 656,000 | -7% |

| District of North Vancouver | $ 758,000 | $ 693,000 | -9% |

| District of West Vancouver | $ 1,288,000 | $ 1,156,000 | -10% |

| City of Surrey | $ 522,000 | $ 497,000 | -5% |

| City of White Rock | $ 478,000 | $ 461,000 | -4% |

| City of Richmond | $ 654,000 | $ 600,000 | -8% |

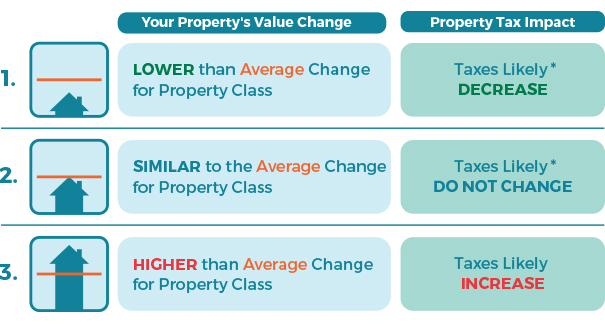

While property values help determine a home’s property taxes, a lower value doesn’t mean you’ll be paying less in property taxes.

As noted on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes. You can find your property class on your assessment notice next to your assessed value.

Click here to find the average change for your property class in your jurisdiction.

Cities throughout the region finalized their budgets and their property tax rates last month and those budgets don’t change based on the value of their constituents’ properties, so the amount homeowners pay will be recalculated based on relative values. For example, if the home values dropped 10 per cent in your community, but your home dropped by 13 per cent, it’s possible your tax bill could stay the same or even dip a little.

But considering the City of Vancouver alone has approved a seven per cent tax hike for 2020, the likelihood of paying less in property taxes this year is slim.

Source: https://bc.ctvnews.ca/residential-property-values-down-across-metro-vancouver-1.4750574 & https://info.bcassessment.ca/propertytax